The Floor Just Dropped: Corporate Giving Won’t Save Public Media

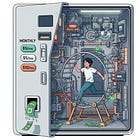

Public media leaders are gambling on corporate support to fill federal shortfalls. But a quiet tax change in Trump’s new law may have stacked the deck against them.

NOTE: This is part of the 💬 Mind the Gap series on mission + money in nonprofit media.

I recently heard a public media CEO work through the implications of the emergency alert clawback and how it could impact his station. When asked whether corporate giving might be able to close a multimillion-dollar gap, he was sure: “Yes, definitely.”

I cringed. Not because corporate giving isn’t worthwhile. It is.

I cringed because corporate giving just got a whole lot harder — by federal law.

Quick clarification: When I mention “corporate giving” in this space, it’s easy (especially in public media) to think solely of underwriting. But this post is focused on something else: philanthropic donations from businesses and corporate foundations. That means cash gifts and in-kind donations (equipment, ad space, etc.) as well as community grants. In many organizations, that work takes place outside of the underwriting department. And under the new tax law, those dollars could be the first to go.

In the middle of President Trump’s “One Big Beautiful Bill Act” is a small provision that rewrites the rules of charitable giving. It’s called a 1% floor.

Pre-Trump: Companies got a tax break for their charitable giving. It was an incentive — a deduction that made financial sense, as well as good.

Post-Trump: A company gets no deduction at all for the first 1% of their taxable income. So a business with $100 million in taxable income gets no tax benefit for the first $1 million it donates.

The old system was a nudge. The new system is a wall.

For the thousands of companies that aren’t philanthropic behemoths, the incentive for community-level giving just went away.

A real world example: In 2013 Eric and Wendy Schmidt — via their foundation with deep Google ties — gave KQED $1.5 million a year to underwrite news and education initiatives. That wasn’t underwriting. It was a philanthropic gift. And it’s exactly the kind of support that could dry up under the new rules.

The story on the bill has centered on the headline item: a return to a universal deduction for small donors. That’s great.

But that sugarcoating has a whole lot of granulated cheaper hidden inside it — and it’s rewriting the incentives for institutional fundraising in ways that could make a bad situation much worse.

📉 What’s at Stake

The bill that claws back federal funding from the Corporation for Public Broadcasting has now passed, and the numbers are final: $1.1 billion is gone.

Now, a second, equally pernicious threat is emerging.

A recent Ernst & Young analysis for Independent Sector projects the new 1% tax floor could trigger a $4.5 billion annual drop in nationwide corporate giving.

If those corporate dollars contract the way the data suggests, it won’t be a theoretical concern.

It’ll erase whatever ground public media stations were trying to claw back.

That CEO isn’t alone. Across the system, many stations have responded by doubling down on the familiar playbook: corporate support, underwriting, major gifts.

And assuming those pieces will just stretch far enough to do the job.

That’s the problem.

If the dollars don’t materialize, the fallback turns into a freefall.

⚠️ The Real Risk

Fundraising experts are already sending out red alerts. Without a tax incentive to back it up, corporate giving may start to shift in all kinds of ways.

Companies could begin retreating from the long-term, relationship-based support public media stations have come to expect

Fewer grants, more one-off gifts

A shrinking field of corporate givers, dominated by only the largest players

More reactive, PR-driven contributions

Fewer dollars for the non-flashy but essential work of keeping stations open

More restricted giving — dollars tied to sexy initiatives, not general operations

That’s a dangerous mismatch in a moment when station flexibility is going to be paramount.

As Politico reported, even business leaders are speaking out. Kathy Wylde, President and CEO of Partnership for New York City — which represents the city’s largest corporate CEOs — was blunt:

“The foundation world fills many gaps,” she said.

“To discourage investment is counterproductive to the president’s goals of getting some of these functions into the private sector and out of government.”

🧭 What Now?

Yes — a shift in focus toward individual giving is possible.

Maybe even a healthy thing.

But it’s only possible if public media leaders stop assuming that the old math will work in this brave new world.

This isn’t a time to panic.

It’s a time to recalibrate — and do the work.

✅ Double down on individual donors.

The universal deduction makes this the clearest and most urgent growth opportunity.

✅ Diversify your revenue streams.

Earned income. Local partnerships. Offbeat collaborations. Leave no stone unturned.

✅ Make your value impossible to ignore.

In a more competitive landscape, clarity of mission is your most valuable asset.

✅ Talk to your corporate partners now.

Check in. Don’t assume their strategy hasn’t already changed.

Ask the question. Start the conversation.

💬 What’s your read on this moment?

Is your organization rethinking its approach to corporate support? Are you already seeing signs of change from funders? I’d love to hear what you’re hearing — or wrestling with — in the comments. Let’s make the strategy part of the conversation, too.

This is such an important observation - the cards could not be more stacked against public media stations right now